The integration of augmented reality (AR) and virtual reality (VR) into healthcare is transforming the industry at an unprecedented pace. As technological capabilities advance and digital health solutions become more widespread, the global market for AR and VR in healthcare is poised for significant expansion over the coming years. This report explores the current landscape, key trends, technological innovations, regional developments, and major industry players shaping the future of immersive health technologies through 2030.

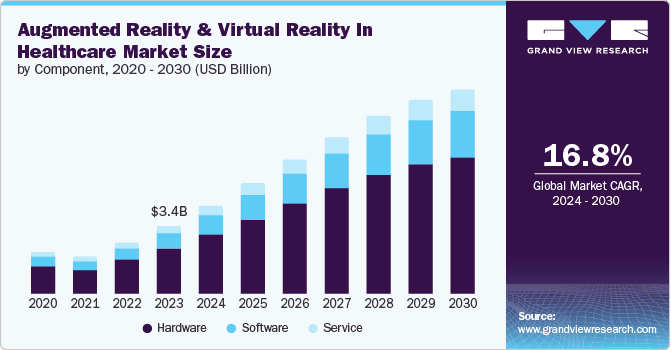

The worldwide AR and VR healthcare market, valued at approximately USD 3.4 billion in 2023, is expected to grow at a compound annual growth rate (CAGR) of 16.8% from 2024 to 2030. This remarkable growth is driven by rapid technological innovations, increased digitalization in medical practices, supportive government policies, rising healthcare expenditures, and the expanding use of immersive tools in surgical procedures and medical training. These developments are revolutionizing how healthcare professionals diagnose, treat, and educate, leading to more effective and patient-centered care.

AR and VR are pivotal in creating immersive experiences that enhance user engagement and comprehension across healthcare domains. AR enhances real-world views by overlaying digital information—such as images, sounds, and text—directly onto physical environments, facilitating interactive learning and visualization of complex medical concepts. VR, on the other hand, offers fully immersive digital environments that transport users into simulated scenarios, providing safe spaces for training, therapy, and patient education. These technologies are not only enhancing medical training but also improving patient outcomes through innovative therapeutic applications.

In medical education, VR is gaining prominence by providing realistic, risk-free environments for practitioners to hone their skills. For example, in March 2023, Dr. Kei Ouchi, an Associate Professor at Harvard Medical School, collaborated with Brigham and Women’s Hospital to develop VR content aimed at emergency care training. Such initiatives enable healthcare providers to practice procedures and decision-making in a controlled setting, ultimately improving clinical proficiency. Similarly, AR applications are transforming anatomical education; in March 2024, Fresenius Medical Care introduced an AR tool to help nurses better understand kidney replacement therapies, enhancing their operational skills within ICU settings through interactive, hands-on learning experiences.

Case Study Insights

A notable example of AR/VR’s clinical impact involves St. Jude Research Hospital’s use of VR as a drug-free method for managing chronic pain. By employing the immersive platform EaseVRx, patients engaged with virtual environments designed to distract from pain, relax, and educate about pain management strategies. This approach has shown promising benefits, including reductions in opioid consumption, fewer hospital admissions, and safer treatment options for individuals intolerant to analgesics.

The healthcare industry is witnessing rapid innovation, evidenced by strategic mergers, acquisitions, and collaborations. For instance, in April 2024, a partnership between SimBioSys and Magic Leap aimed to enhance surgical oncology procedures using advanced AR technology. These industry moves are expanding technological capabilities and geographic reach, helping companies penetrate new markets and improve their offerings. Regulatory frameworks also play a crucial role; companies must secure FDA clearance or equivalent approvals to launch AR/VR devices, ensuring safety and efficacy.

Geographic expansion strategies are vital in capturing emerging markets. In April 2023, XRHealth merged with Amelia Virtual Care, creating a unified platform for virtual healthcare services across the U.S. and Europe. North America led the market in 2023 with a 39.1% share, driven by high adoption rates, substantial investments, and supportive policies. In the U.S., collaborations such as SimX’s partnership with the U.S. Air Force exemplify efforts to develop AR/VR training platforms for military healthcare personnel. Europe’s market growth is supported by initiatives like the VReduMED project, funded by the European Regional Development Fund, which aims to leverage VR for healthcare education and service improvement.

Component and Technology Segment Insights

Hardware remains the dominant component, accounting for approximately 67.4% of market revenue in 2023. Devices such as head-mounted displays, smart glasses, and 3D sensors are widely used in surgical simulation, diagnostics, training, and remote mentoring. For example, in January 2024, Ocutrx Technologies launched the ORLenz headset, designed to replace traditional surgical loupes with a high-resolution digital alternative that enhances surgeon comfort and precision.

The service segment is expected to experience the fastest growth, as the complex nature of AR and VR technology necessitates specialized implementation, ongoing support, and customization. Healthcare providers increasingly seek tailored solutions that seamlessly integrate with existing systems—such as medical imaging devices—and require continuous training and maintenance. The growing demand for immersive medical education and simulation drives service providers to offer comprehensive training programs and software updates, ensuring effective deployment and sustained ROI.

Interesting:

- The future of healthcare growth and innovation in augmented and virtual reality technologies

- The growing influence of augmented reality in healthcare by 2030

- Predictions and trends what is the future of ai in healthcare

- The transformative power of mobile healthcare and ai in shaping patient care by 2025

Technology Type Trends

AR technology led the market in 2023, holding a 58.7% share, primarily due to its applications in surgical planning, minimally invasive procedures, and real-time visualization. Technological advances and rising demand for less invasive interventions fuel this trend. Companies like Vuzix have partnered with telemedicine firms such as VSee to develop smart glasses that support remote diagnostics and consultations.

VR is anticipated to grow at a faster rate during the forecast period, supported by increasing investments from healthcare technology firms. Notably, in September 2022, OssoVR secured USD 14 million to expand its VR surgical training modules, reflecting the sector’s confidence in virtual training solutions. VR’s capabilities in surgical simulation, robotic surgery, phobia treatment, and pain management are expanding its applications and market presence.

Regional Market Outlook

North America remains the largest market, driven by high adoption rates, extensive R&D investments, and innovative healthcare initiatives. In October 2023, Surgical Theater collaborated with Stanford Medicine to perform the first spine surgery utilizing its AR technology with Microsoft HoloLens headsets, exemplifying cutting-edge medical procedures. The U.S. government’s support through programs like the Small Business Innovation Research (SBIR) has further accelerated development and deployment.

Europe’s market is also experiencing robust growth, supported by government initiatives like the VReduMED project, which aims to enhance healthcare training through VR. Germany and the UK are notable markets; in Germany, Fresenius Medical Care has employed VR technology for patient training in peritoneal dialysis, while UK institutions are integrating VR scenarios into medical curricula to provide near-real-life clinical experiences.

Asia Pacific is poised to become the fastest-growing region, fueled by increasing healthcare infrastructure, rising awareness, and the adoption of AR/VR solutions in hospitals and clinics. Japan leads with significant investments, exemplified by Asteria Corporation’s funding into Holoeyes, a medical VR software provider. India’s expanding healthcare sector is also adopting AR and VR for diagnostics, training, and patient care, with hospitals utilizing these tools for enhanced medical outcomes.

Industry Leaders and Recent Developments

The competitive landscape features major players such as CAE Healthcare Inc., Siemens Healthineers, Koninklijke Philips N.V., and others. These companies are actively developing new products, forming strategic alliances, and acquiring startups to strengthen their market positions. Recent innovations include Siemens Healthineers’ app for Apple Vision Pro, offering immersive holograms of the human body for educational and surgical planning purposes.

In December 2023, EON Reality renewed its partnership with the Children’s Hospital of Orange County to advance pediatric healthcare education through AR and VR. CAE Healthcare launched an updated cardiac training simulator, incorporating Microsoft HoloLens 2 to enhance realism in cardiovascular procedures.

As the market continues to evolve, the global AR and VR in healthcare industry is projected to reach USD 11.3 billion by 2030, with a CAGR of 16.8%. This growth underscores the transformative potential of immersive technologies in delivering safer, more effective, and personalized healthcare solutions across the globe.

For further insights into insurance considerations and regulatory updates, explore the comprehensive guide to chiropractic insurance coverage with UnitedHealthcare and the recent changes in Medicare policies affecting therapy and chiropractic services. To optimize your healthcare benefits through these innovative coverage options, visit maximize your benefits with UnitedHealthcare chiropractic and physical therapy coverage.