Women living in states with restrictive insurance laws face significant obstacles when seeking abortion coverage through private health plans. As state legislatures continue to impose bans and limitations, many women find themselves with limited or no options for coverage, even if they wish to include abortion services in their health benefits. These policies create a patchwork of access that heavily depends on geographic location, leaving many women vulnerable and without adequate options for reproductive care.

Data Note

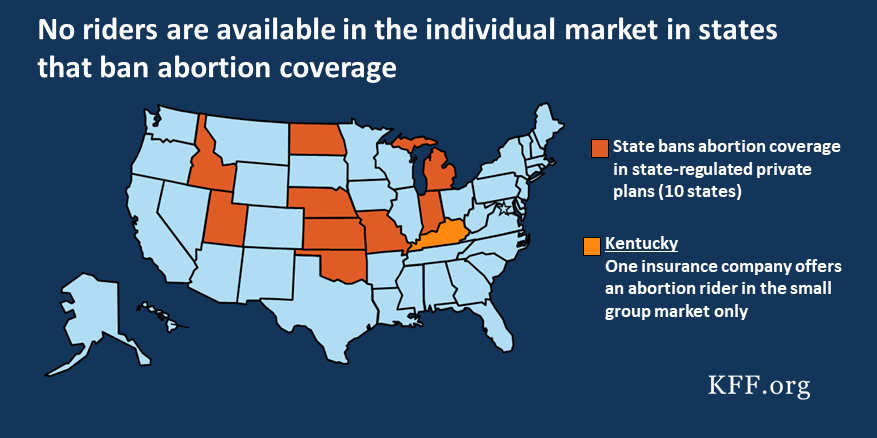

Current data reveals that 10 states have enacted laws that prohibit insurance companies from offering abortion coverage within their private plans. Notably, a new law in Texas, scheduled to take effect in April 2018, further restricts coverage. Most of these laws do not include exceptions for pregnancies resulting from rape or incest, making them more restrictive than federal policies under the Hyde Amendment, which permits abortion coverage in specific circumstances such as rape, incest, or when the woman’s life is endangered.

In the 2018 plan year, nine of these states permitted the sale of abortion riders—add-on policies that provide coverage for abortion procedures. However, outside of these riders, abortion coverage is generally unavailable in the individual market. In fact, only one insurance company in Kentucky offered such a rider in the small group market for HMO and PPO plans. No abortion riders are currently accessible in the large group market, and in states with outright bans, women who hold policies in these regions have no legal avenue to purchase abortion coverage through their insurance plans.

The restriction of abortion coverage varies significantly across states. While federal law limits Medicaid funds for abortion under the Hyde Amendment, several states—like California, New York, and Oregon—mandate that most private plans include abortion services, highlighting the diverse policy landscape. Supporters of restrictions argue that abortion is not a health service or that policyholders should subsidize coverage only if they choose to do so. However, the reality for many women is that, in restrictive states, the option to buy separate abortion riders is virtually nonexistent, effectively resulting in a ban on coverage.

Background

Before the Affordable Care Act (ACA) was enacted in 2010, four states had outright bans on abortion coverage in private health plans. Since then, seven more states have enacted similar restrictions for plans outside the ACA Marketplace. These laws generally apply to all individual policies and fully insured group plans—covering most insurance products sold within the state—though self-insured plans are regulated federally under ERISA and are not subject to state mandates.

Currently, ten states prohibit abortion coverage in all private plans, with few exceptions. For example, Utah’s law, effective in 2012, does not permit the sale of abortion riders at all. In contrast, nine of these states allow insurers to sell riders for abortion coverage, providing a potential pathway for women to purchase supplemental coverage if available. Yet, actual availability remains limited.

State Laws Prohibiting Abortion Coverage in Private Plans (Selected Examples):

| State (Effective Date) | Exceptions to Law | Notes |

|————————-|———————|——–|

| Idaho (1983) | None | |

| Indiana (2015) | Rape, Incest, Life Endangerment | |

| Kansas (2011) | Rape, Incest, Life Endangerment | |

| Kentucky (1984) | Rape, Incest, Severe Health Threat | |

| Michigan (2014) | Fetal reduction | Limited exceptions |

| Missouri (1983) | Rape, Incest | |

| Nebraska (2012) | Rape | |

| North Dakota (1979) | Rape | |

| Oklahoma (2011) | Rape, Incest | |

| Texas (2018) | Rape, Incest, Severe Health Threat | Effective April 2018 |

Interesting:

- The impact of the change healthcare data breach on healthcare security

- Navigating the health insurance marketplace your guide to affordable coverage

- The impact of hipaa regulations on healthcare institutions

- Simplifying access to breast pumps through insurance coverage

- Comprehensive guide to chiropractic insurance coverage with unitedhealthcare

Despite the restrictions, the debate around abortion coverage remains heated. Many argue that abortion is not a health service or oppose making policyholders subsidize procedures they oppose. Still, women in states with bans often cannot anticipate their need for abortion services, as nearly half of pregnancies in the U.S. are unintended. When seeking an abortion, women may have experienced unplanned pregnancies, rape, incest, or fetal anomalies incompatible with life, or they may face health complications that threaten their well-being.

How Much Does an Abortion Cost?

The expense of an abortion varies depending on gestation, provider, and procedure type. At around 10 weeks, the cost ranges from $400 to $550, while later procedures at 20-21 weeks can cost $1,100 to $1,650 or more. Most women pay some out-of-pocket, with a 2011 study noting that even women with private insurance often do not use their coverage for abortion services—either because their plans do not cover it or due to uncertainty about coverage.

A health insurance rider functions as a supplementary policy covering specific services not included in standard plans. For example, some individuals purchase riders to cover cancer treatments or dental work. These riders are typically optional amendments that can be added to group or individual policies, often at an additional premium. In the context of abortion, a rider would operate similarly—purchasable separately, and only if available from the insurer.

In the group market, employers can choose to add riders for their employees, but these are rare, especially in states that prohibit abortion coverage entirely. For individuals in the private market, purchasing such a rider requires recognizing the coverage gap and paying extra premiums, which may be prohibitively high. Historically, before the ACA mandated maternity coverage, women had to buy separate maternity riders—often expensive and limited in scope—to cover childbirth. The ACA eliminated the need for such riders by making maternity care an essential health benefit.

How Much Do Abortion Riders Cost Insurers?

From an insurer’s perspective, providing abortion coverage does not significantly increase costs. Estimates from 2012 suggest that the additional expense per member per month (PMPM) was between 11 and 33 cents, compared to a minimal premium increase of $1 PMPM required by law. Because these costs are dispersed across large pools of enrollees, offering abortion coverage remains financially feasible for most insurers.

Methodology

To assess the availability of abortion riders in states with restrictions, we examined the systems used by insurance companies to file plans and forms, specifically the System for Electronic Rate and Forms Filing (SERFF). We focused on nine states with restrictions in 2017 that do not ban the sale of abortion riders, excluding Utah where sale of such riders is not permitted.

Between August and December 2017, we scrutinized filings for plans containing terms related to pregnancy or abortion, then confirmed availability with state insurance departments. Despite the effort, no insurers offered abortion riders in the individual market within these states for 2017 or 2018. Kentucky approved two riders for small group plans in 2018, but their premiums and actual purchase rates remain unknown.

How Available Are Abortion Riders?

In the 2017-2018 period, abortion riders were virtually nonexistent in the individual market in states with bans, affecting an estimated 700,000 women of reproductive age. In Texas, when the new law takes effect in April 2018, an additional 467,000 women will be impacted. Women in these states have no legal means to purchase separate coverage for abortion services in the private market.

| Year | State(s) | Insurance Provider | Market Type | Status |

|——–|————|———————–|————–|———|

| 2017 | Michigan (Employer-specific) | Priority Health | Group | Purchased by one employer |

| 2018 | Kentucky | UnitedHealthcare | Small Group | Approved but unavailable for purchase |

| 2018 | Kansas | UnitedHealthcare | Large Group | Pending approval |

These limited offerings illustrate that, in practice, abortion riders are almost entirely absent in states with bans, making coverage effectively unavailable.

Conclusion

Women enrolled in individual plans in states with restrictions face almost no chance of obtaining abortion coverage. In the group market, availability depends heavily on employer decisions and insurer offerings, which are exceedingly rare. Laws that prohibit abortion coverage but allow for riders serve as de facto bans, since the few available riders are rarely, if ever, purchased or offered. As states continue to restrict access, and federal efforts to limit abortion coverage persist, many women—especially those who are victims of rape, incest, or facing health risks—will find themselves without insurance options for this essential procedure. The ongoing legislative landscape indicates that, despite legal and policy debates, access to abortion and related coverage remains severely limited in many parts of the country.

—

For further understanding of how insurance plans are governed and regulated, explore this resource on healthcare data governance. Additionally, insights into the use of artificial intelligence across healthcare sectors can be found in mapping AI’s role in healthcare. Protecting patient rights and privacy remains a critical concern, detailed in what is data privacy in healthcare. Looking ahead, understanding future developments and trends in AI’s impact on healthcare is essential, available at future of AI in healthcare.