Navigating the complexities of health insurance can be challenging, especially when it comes to understanding how claims work. A clear grasp of what a health insurance claim entails is essential for ensuring you receive the benefits you’re entitled to and for avoiding unnecessary delays or denials. Whether you’re a new policyholder or someone familiar with insurance processes, knowing the ins and outs of claims can help you manage your healthcare expenses more effectively.

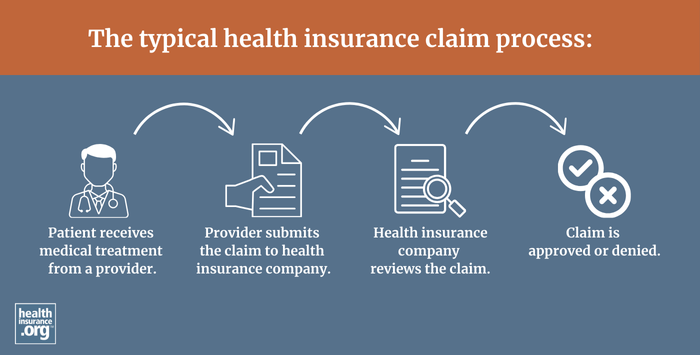

A claim is essentially an application made to your health insurer requesting reimbursement or direct payment for healthcare services you or your healthcare provider have received. Typically, when you visit a medical professional, the provider will file the claim directly with your insurance company if they are within your network. This process often simplifies the reimbursement process for you. However, if you choose an out-of-network provider, you may need to handle the claim submission yourself, which involves paying for the service upfront and then submitting the necessary paperwork to your insurer for reimbursement. Understanding this process is crucial because it affects how quickly and smoothly your healthcare costs are covered.

Most health insurance plans also require prior approval—often called pre-certification or prior authorization—for certain treatments that aren’t emergencies. This step happens before the treatment or procedure takes place and is separate from the actual claim submission. Securing this approval ensures that your insurer agrees to cover the service, whereas submitting a claim confirms that the service has already been rendered. Keep in mind that even after filing a claim, it may be denied if the insurer determines the treatment wasn’t eligible or if there are issues with the documentation. In these cases, there are established appeals processes that both patients and healthcare providers can use to challenge a denial and seek fair reimbursement.

Understanding related concepts such as balance billing—which occurs when providers bill patients for the difference between the provider’s charge and what the insurer pays—and reasonable and customary fees—which refer to the typical charges for specific services in a geographic area—can further clarify how claims and payments are processed.

Interesting:

For a broader understanding of how technology influences healthcare, exploring how artificial intelligence is integrated into healthcare ecosystems can be insightful. You can learn more about the various applications of AI in health sectors by visiting resources that explore the integration of innovation and technology in medicine. Additionally, protecting patient data is a critical aspect of modern healthcare, with data privacy measures ensuring sensitive information remains confidential. To understand how institutions safeguard this information, explore resources on data privacy in healthcare.

As healthcare continues to evolve, so do the trends and future predictions for AI’s role in medicine. Staying informed about the latest developments can help you anticipate changes that might impact your coverage and claims process. Moreover, data analytics plays a vital role in healthcare by unlocking insights that improve patient outcomes and operational efficiency. Learning about big data analytics can give you a sense of how data-driven decision-making shapes modern healthcare practices.

If you want to explore your insurance options or need assistance with coverage, consulting licensed insurance agents can be invaluable. They can help you navigate the complexities of insurance policies, including understanding claims procedures and maximizing benefits. Whether you’re dealing with claim denials or simply seeking better coverage, being informed is your best tool for managing healthcare costs effectively.